Nine Musts for the Modern Financial Application

For many years, financial applications were largely enterprise applications that were rarely updated. They may have been used by internal team members performing routine tasks over and over again.

Today, however, financial applications have been extended to sophisticated end users that expect simple, elegant design — much like other consumer applications they use. This means that financial systems need to be updated. But where do you start? Below are nine musts for your financial application in today’s world.

1. Demonstrate Value Immediately

Did you know that the average mobile app loses 80% of its users within just three days?* That’s astounding and troubling. But that is the reality we are living in. With the important need to protect data in the financial sector, often we put up barriers to usage.

Instead, we need to protect data while building natural sticky mechanisms upfront to drive usage and adoption.

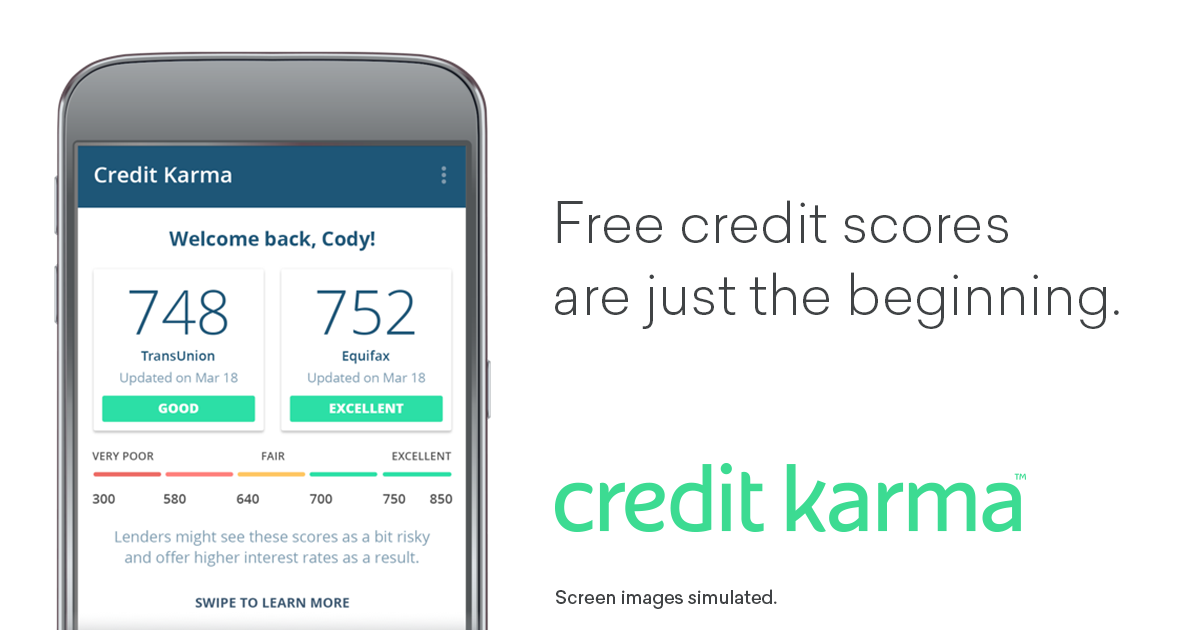

For example, Credit Karma — one of the top 10 Fintech companies to watch in 2019 — does not require users to register a credit card, unlike other sites. Also, as part of their services, Credit Karma also offers educational resources for their users — of which there are reportedly 85 million.

2. Paint a Broader Picture

If we think of managing finances in terms of Maslow’s hierarchy of needs, reporting accurate data is the staple or baseline need. And while traditional financial solutions have done a good job reporting financial information — in today’s world they will need to do more.

The opportunity for your current financial application is to present a clear sense of progress on a path toward financial health. Not only should you show progress, but you should visually display opportunities and recommendations as well.

For example, Mint helps consumers track their expenses and income in a graphical user interface.

3. Personalize and Build Trust

With Fintech products, the stakes are high, and personalization is essential in creating trust; consumers need to feel an emotional connection with their service. Personalization has to replicate or replace the personal touch you would get when opening a bank account in person or signing up for any other service over the phone. Without that human-to-human interaction, it’s hard to build trust. The most successful Fintech products know this only too well. And each of them goes out of their way to tailor a personalized service.

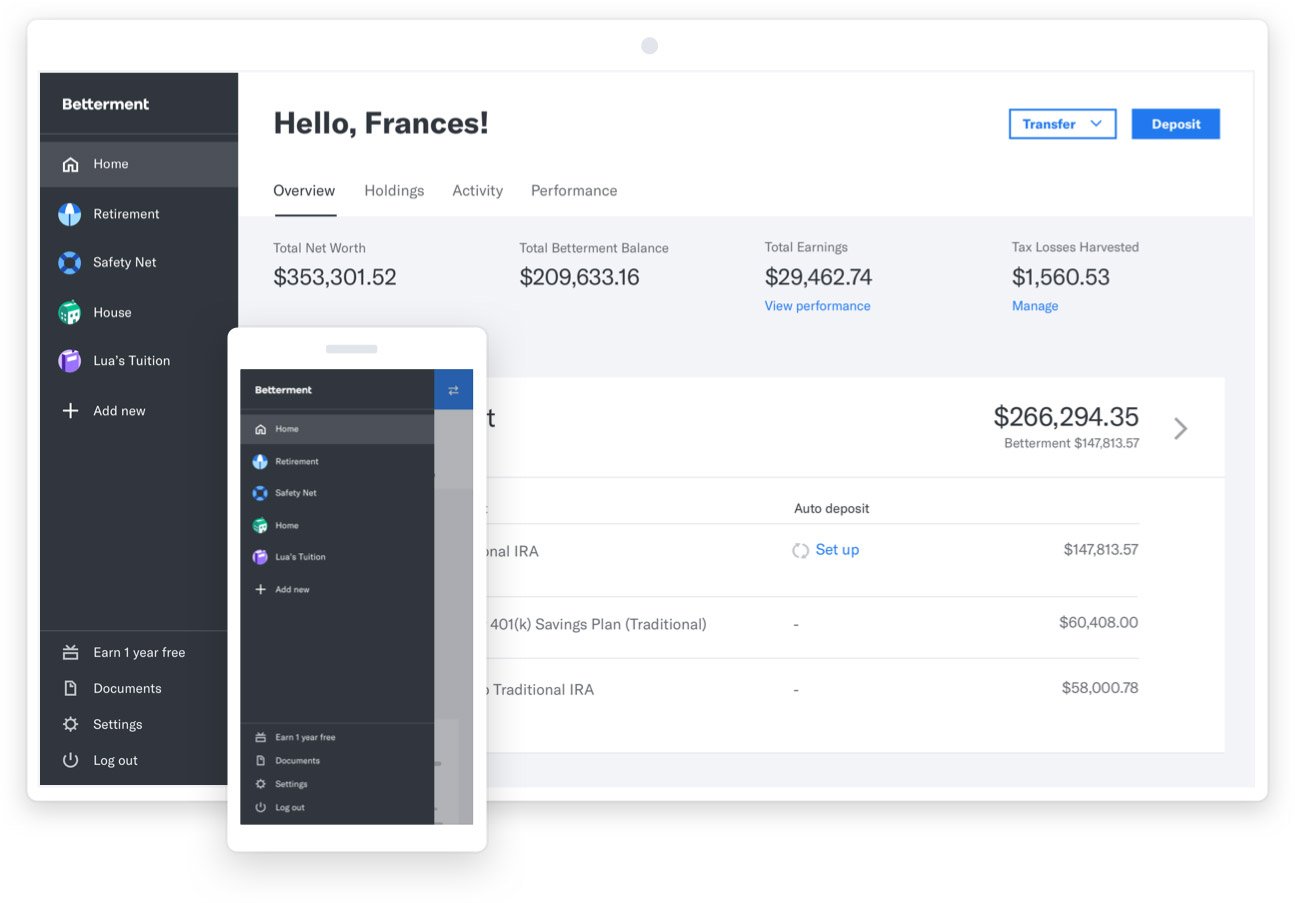

In fact, so important is it to build those human relationships that certain services (such as Betterment) now offer a hybrid model. By augmenting their robust digital tool with access to a person, Betterment’s customers get all the promise of the platform’s technological wizardry with the reassuring old world charm of human interaction.

4. Mind the Millennial (or Target Market)

More and more, financial applications are being built for the millennial or digital native. Why? Not necessarily because that is where the investment funds are, but because this generation grew up with technology, so their requirements are more simplified, natural and fluid.

With respect to Fintech UX, design has to be simple, smart, and in line with digital expectations. Your applications also need to be relatable and easy to use.

5. Simplify the Experience

We always recommend simplicity when it comes to design. That is because a cluttered or convoluted UI makes it harder to interact. And nowhere could this be more important than with a financial application.

With respect to Fintech, you’ll not only want simple clear messaging, but you may need to put information into smaller chunks — with the goal of removing barriers to entry or improving engagement.

For example, Oscar is looking to bring health insurance into the 21st century by simplifying the customer experience. One of Oscar’s “top priorities is to provide an intuitive, member-friendly product that gives members access to their health information anytime, anywhere.”

6. Affirm Users’ Actions

When it comes to financial data, there is a natural mistrust or fear of cybersecurity or loss. To assure users, we need to reaffirm actions and build trust online; one interaction at a time — so as to remove any doubt.

7. Make Actions Effortless

Traditionally, financial institutions earned a reputation of being overly bureaucratic. While, in the past, users have gone along with this, the digital world brings the possibility of disruption.

While your application needs to be secure, it also needs to be easy to interact with. Users should be able to look up information and transact with ease if you are to retain or grow those relationships.

8. Provide Actionable, Informative Visualizations

While you have access to more raw data today than ever before, it doesn’t mean much if your users don’t know how to consume it — especially with 65% of the population identifying as visual learners.

Now users expect to see only useful, visual insights versus raw data. This means new UX will need to serve up only pertinent information in a visually engaging way.

9. Delight the User

You don’t often hear about a wonderful experience with a financial application, but the opportunity to provide that experience exists. If you are able to save the user time or share insightful information easily and with a beautiful UI you’ll not only help the user complete their task, but keep them coming back.

Get Started Now

Do you have a financial application that could benefit from one of these recommendations? Contact us. We’ll show you an approach you can take for unifying or modernizing your UX that is efficient and cost-effective.

*According to Andrew Chen of Andreesen Horowitz, the average mobile app loses 80% of its users within just three days of initial download. And a staggering 95% within 90 days.